Banks are selling your data. Here’s the evidence

You are probably aware big-tech profits from your data, but did you know that banks are doing the same too?

Data and Ethics

As we approach the five year anniversary of the Cambridge Analytica expose, it would seem that in those five years:

Most people are now aware that technology platforms mine their personal data for monetary gain.

Regulators are clamping down, limiting the ability of companies to exploit personal data without clear consent.

And data… continues to fuel our digital economy.

It is safe to say that ‘trust’ on how our data is used by organisations is at an all time low.

Data ethics has become an important issue, with 9 in 10 people stating that it is important that organisations interact with their data ethically in the poll below by the Open Data Institute.

Interestingly, despite the low trust - in relative terms, people trust how banks use their data more than their government, and certainly a lot more than their social media platforms.

But I wonder, do these people know that banks sell our data too? Yep, banks are selling your data…

Continue reading below as I show you some proof and size up the market.

Purchase Intelligence

Cardlytics, a publicly traded marketing and insights company has built its business on consumer transaction data. The company partners with banks to access their customer banking data to provide:

a) Insights and advertising opportunities for retailers

b) White label rewards programmes for their banking partners

Their Purchase Intelligence solution gives retailers valuable insight into consumer spending behaviour:

It is a profitable business as they closed $267 million in revenue in 2021 with $137 million being shared with their banking partners - which is pretty much a 50/50 revenue share.

The data Cardlytics use is anonymised and is clearly very valuable. They partner with the largest banks in the US and UK, including Lloyds Bank, Bank of Scotland, Halifax and Santander this side of the Atlantic.

A Billion Dollar Market

Cardlytics states that it has access to 184 million customer accounts. Considering there are about 6 billion people who have bank accounts around the world, and using the $137mn figure that Cardlytics’ banking partners received - the global market for bank transaction data can be sized in the region of $4.5bn. For now, let’s just say that it’s in the range of $3 - $5bn given other factors such as geographic variation.

It is not just Cardlytics, there are other sources where you can access similar datasets as you can peruse through on data marketplaces.

So, yes - banks are selling your data. It is not illegal, you signed their terms and conditions allowing them to do so. (Just like you did with Facebook’s T&Cs too…)

But is it ethical? Was the consent clear?

Fairtrade Data

What if the people who are part of creating this data get a cut for it?

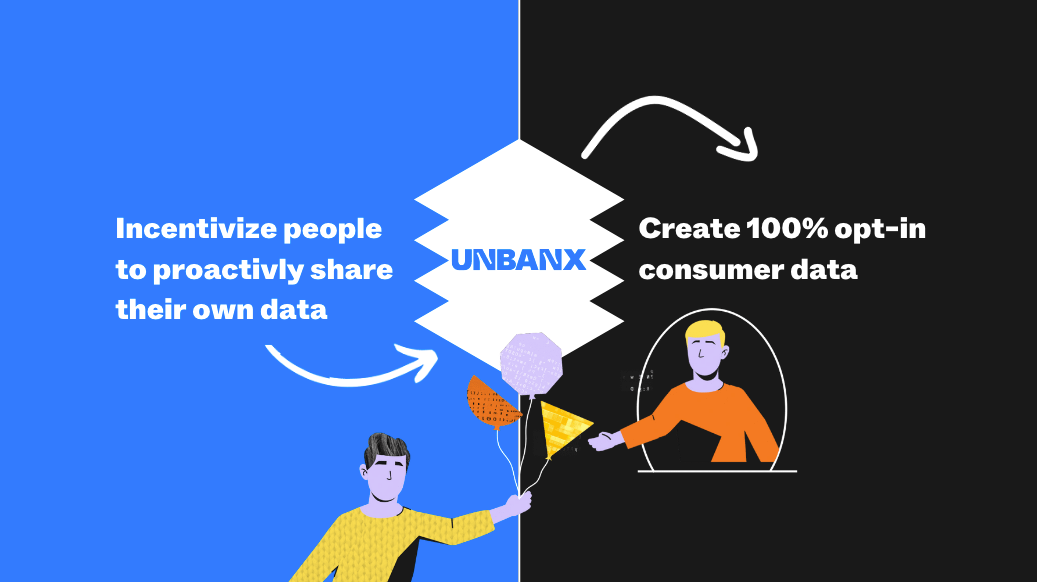

At Unbanx we want to give people the choice to earn from their data by selling these valuable insights and datasets ethically.

For data buyers, it is not only compliant and ethical data - it is high quality data with provenance. And if you want deeper insights, we can further incentivise the consumers to share more data.

It’s time for a fairer data economy.

Stay tuned, as we take the first step towards that and launch our consumer rewards app at the end of the month.